Hindenburg’s Latest Tweet : What Does “Something Big Soon” Mean for India?

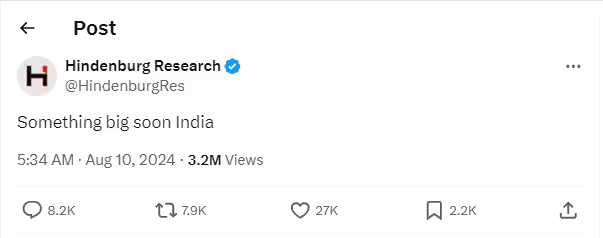

The world of finance has been set alight by a single tweet. On August 10, 2024, Hindenburg Research, the infamous short-seller, posted a cryptic message on X (formerly Twitter): “Something big soon India.”

Those four words have stirred up a storm of speculation and anxiety, especially considering the firm’s history of targeting powerful companies and causing massive disruptions in the stock market.

But what exactly could Hindenburg be hinting at? Could this be another bombshell like the one they dropped on the Adani Group last year? Let’s dive into the mystery.

A Glimpse into Hindenburg’s Track Record

To understand the weight behind Hindenburg’s tweet, it’s important to look at their track record. Hindenburg Research isn’t just any financial firm; they specialize in short-selling, a practice where they bet against companies they believe are overvalued or engaged in fraudulent activities.

Their most infamous report, released in January 2023, targeted the Adani Group, one of India’s largest and most influential conglomerates. The report accused the Adani Group of financial misconduct, including stock manipulation and accounting fraud, leading to a massive loss in market value—over $86 billion was wiped out in a matter of days.

This report didn’t just affect Adani; it sent shockwaves through the entire Indian stock market and sparked a global debate on corporate governance and the role of short-sellers. Despite Adani’s efforts to defend itself and regain investor confidence, the damage was done.

The market’s reaction to the Adani report has left many wondering what Hindenburg’s next target could be, especially after their recent tweet.

The Mysterious Hindenburg Tweet: “Something Big Soon India”

So, what does Hindenburg’s latest tweet mean? The short answer is: no one knows for sure. The tweet, “Something big soon India,” is intentionally vague, leaving the financial world in suspense. However, this ambiguity is precisely what makes the tweet so powerful. In the absence of details, speculation is running wild.

Some believe that Hindenburg might be preparing to release another report targeting a major Indian corporation.

Given the size and influence of the companies Hindenburg has previously targeted, this could mean a conglomerate in sectors like banking, infrastructure, or energy. These industries are crucial to India’s economy, and any negative report could have widespread repercussions.

The Ripple Effect: How the Market Is Reacting

The immediate reaction to Hindenburg’s tweet has been one of caution. Investors are on edge, remembering the chaos that followed the Adani report.

After all, the financial fallout from that report was severe. While the Indian market eventually recovered, with the Sensex rallying by approximately 20,000 points since January 2023, the scars from that event have not fully healed.

However, not everyone is convinced that Hindenburg’s next report will have the same impact. Some market analysts argue that the Indian market is more resilient now and that investors are better prepared to handle such shocks.

They point out that despite the significant drop in Adani’s stock prices, the broader market managed to bounce back relatively quickly. This suggests that while Hindenburg’s reports can cause short-term panic, the long-term impact may be less severe.

What Could Hindenburg Be Planning?

Given the secrecy surrounding Hindenburg’s operations, it’s difficult to predict who or what they might target next. However, there are a few possibilities that are worth considering.

One theory is that Hindenburg could be targeting another large conglomerate similar to the Adani Group. India is home to several massive corporate entities that wield significant influence over the economy. If Hindenburg were to release a report on one of these companies, it could have far-reaching consequences.

Another possibility is that Hindenburg might be focusing on a different sector this time. While their report on Adani was centered around allegations of stock manipulation and fraud, their next target could be a company in the financial sector, especially given the importance of banking and finance in India’s economy.

A report targeting a major bank or financial institution could have even more profound implications, potentially affecting not just the company in question but the entire financial system.

The Role of Regulators: A Test for SEBI

Another critical aspect to consider is the role of regulators, particularly the Securities and Exchange Board of India (SEBI). After the Adani report, SEBI faced criticism for its handling of the situation. Critics argued that the regulator was slow to act and that its measures were insufficient to prevent the market disruption that followed.

SEBI’s response to any new Hindenburg report will be closely watched. In the aftermath of the Adani report, SEBI did issue a show-cause notice against Hindenburg, accusing the firm of violating Indian regulations.

However, Hindenburg dismissed the notice as an attempt to silence its investigations, further fueling the controversy. If Hindenburg does release another report, SEBI’s response will be crucial in determining the impact on the market and investor confidence.

The Psychological Impact: Fear and Speculation

Beyond the immediate financial implications, Hindenburg’s tweet has also had a significant psychological impact. The fear of the unknown is a powerful force in the markets, and it’s cryptic message has played into this fear perfectly.

By leaving out specific details, Hindenburg has created an atmosphere of suspense and uncertainty, which can be just as damaging as a detailed report. This psychological impact is compounded by the fact that Hindenburg has a history of being right.

Their reports are typically well-researched and backed by extensive evidence, which means that when they hint at something big, people listen. The mere suggestion of another major report has been enough to send ripples through the market, with investors scrambling to guess who the next target might be and how to protect their assets.

Hindenburg’s activities also raise broader questions about corporate governance in India. The Adani controversy highlighted the risks associated with concentrated corporate power and the potential for financial misconduct in large conglomerates.

If Hindenburg’s new report targets another major player, it could once again bring these issues to the forefront.

Moreover, the reaction to tweet reveals a deep-seated anxiety about the health of India’s corporate sector. While the Indian market has shown resilience, the possibility of another major scandal could shake investor confidence and lead to calls for more rigorous oversight of corporate practices.

Waiting for the Next Move

As the financial world waits with bated breath, one thing is clear: this tweet has successfully captured the attention of investors, regulators, and the public alike. The suspense surrounding the tweet is palpable, and the potential consequences of whatever Hindenburg is planning could be significant.

In the coming days, the speculation will only intensify. Analysts, investors, and market watchers will be trying to read the tea leaves, searching for any hints about who or what might be the next target of it’s scrutiny. And while the details remain a mystery, the anticipation of what’s to come is enough to keep everyone on edge.

The tweet may have been short, but its impact has been anything but. Whether this will lead to another market-shaking report or turn out to be a false alarm remains to be seen. But one thing is certain: Hindenburg has once again demonstrated its ability to move markets with just a few carefully chosen words.

In the world of finance, where uncertainty can be as powerful as any economic indicator, it’s latest tease is a reminder that sometimes, the most significant events start with the smallest of hints. All that’s left now is to wait—and prepare for whatever comes next.

Also Read Our Latest Blogs On :

Phir Aayi Hasseen Dillruba 2024: A Sequel That Struggles to Recapture the Magic of the Original